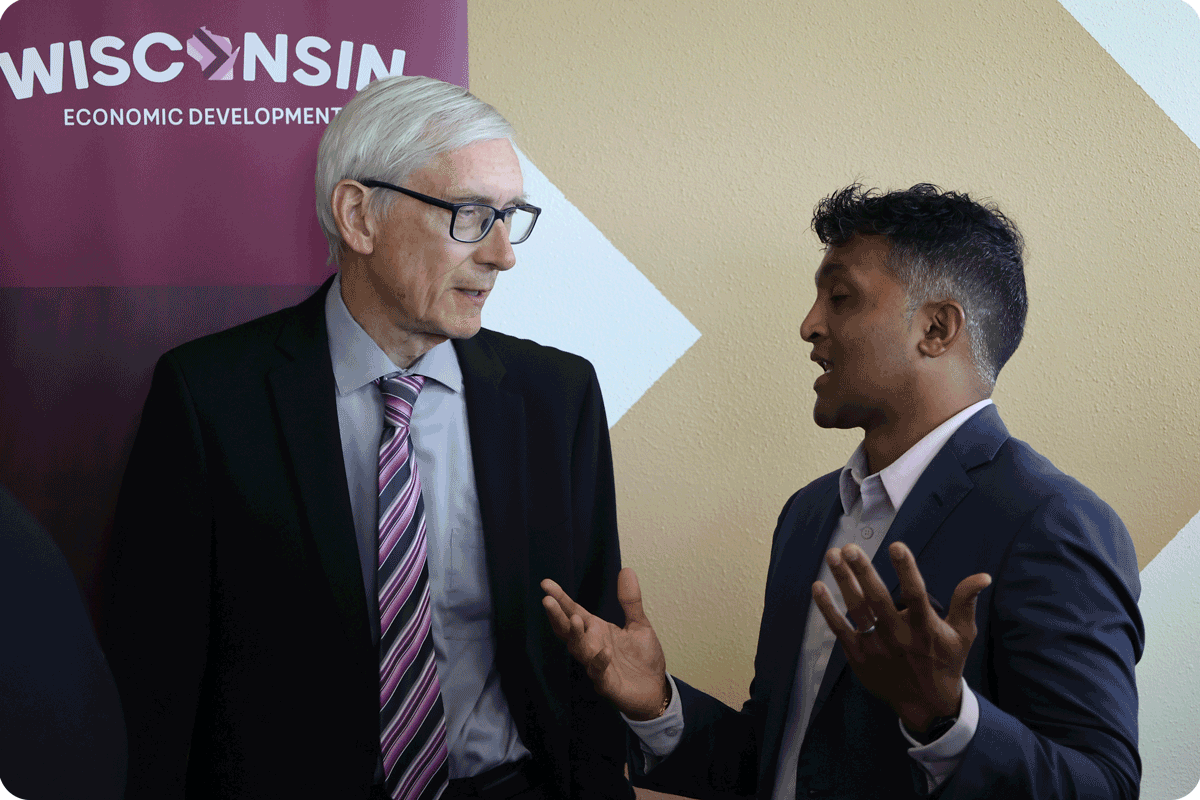

Gov. Tony Evers and Vivek Swaminathan, CEO of Cardamom Health

Wisconsin Investment Fund partnerships include focus on tech, agriculture, manufacturing, and biohealth

MADISON — Gov. Tony Evers, together with Wisconsin Economic Development Corporation (WEDC) Secretary and CEO Missy Hughes, today announced a major step forward in supporting Wisconsin entrepreneurs with the launch of the Wisconsin Investment Fund, a public-private venture capital initiative that will initially invest $100 million in startup businesses throughout the state. At an event at Forward BIOLABS in Madison, a nonprofit that has helped launch scores of successful startups, Gov. Evers and Secretary Hughes were joined by officials from five venture capital management firms who will be administering the first round of fund investments. A sixth capital management firm will be announced shortly.

“The Wisconsin Investment Fund will be the biggest public-private investment in Wisconsin startups and entrepreneurs in our state’s history, and as the businesses that receive these investments start to grow, the value of the fund will grow with them, creating new opportunities to help even more businesses expand,” said Gov. Evers. “Over time, we expect the value of this fund to grow exponentially—with a ten-to-one private-public investment ratio. This fund is a win for businesses who will have the support to take their ideas to new heights, and it’s a win for Wisconsin to maintain our position as a competitive leader in business innovation.”

“This partnership will help more entrepreneurs scale their businesses, create jobs in emerging fields, and ensure that Wisconsin can continue its long legacy of being innovators and trailblazers,” said U.S. Sen. Tammy Baldwin (D-Wisconsin). “I am proud to do my part to support this initiative, giving more Wisconsinites opportunity and growing the next generation of our Made in Wisconsin economy.”

“Wisconsin has always been a leader in bringing great, innovative ideas to the world,” said WEDC Secretary and CEO Hughes. “To make those ideas a reality and drive our state’s economy forward, innovators need capital. This public-private effort puts a stake in the ground that Wisconsin is committed to entrepreneurship and innovation.”

The venture capital firms must match each dollar of public funds with at least one dollar of private money, which will initially double the state’s investment impact. The state’s return on these investments is then reinvested into the Wisconsin Investment Fund to generate more capital and fund even more promising Wisconsin companies.

The U.S. Treasury’s State Small Business Credit Initiative (SSBCI) is providing the $50 million that will make up the state’s portion of the investment fund. Over the first years of the fund, WEDC anticipates creating at least a $500 million impact as the companies selected by the fund continue to grow.

Wisconsin’s fund will be investing in innovative companies working in technology, healthcare, agriculture, manufacturing, and other areas. As required by the SSBCI program, Wisconsin’s fund is targeting significant support for diverse businesses and companies located in underserved areas of investment.

A particular focus will be biohealth, with at least $27 million of the state’s initial investment allocated to that sector. Last year, the U.S. Economic Development Administration designated Wisconsin as a Regional Technology Hub for personalized medicine and biohealth technology, which opens the door to up to $75 million in new federal funding to help accelerate research and development of new treatments.

Wisconsin Investment Fund Committee members reviewed applications from 31 fund managers in a competitive bidding process and selected the final investment firms. The private fund partners and the amounts being invested with them include:

HealthX Ventures | $15 million

Madison-based HealthX Ventures invests in innovative companies making healthcare safer, more efficient, and more affordable by delivering easy-to-use, cost-effective, and scalable solutions to the market. HealthX was founded by Mark Bakken and is led by seasoned, successful entrepreneurs and investors. The team provides exceptional value to portfolio companies through extensive operational support, deep industry knowledge, and executive-level networking.

“We are proud to be a part of WEDC’s Wisconsin Investment Fund,” said Mark Bakken, founder and managing director, HealthX Ventures. “Wisconsin has a strong healthcare ecosystem, and this fund will provide great opportunities for health-related startups in Wisconsin seeking to build off of it.”

Venture Investors Health Fund | $12 million

Venture Investors Health Fund, based in Madison and Milwaukee, focuses on commercializing early-stage healthcare innovations developed in the world-class research universities of the U.S. Midwest, such as the University of Wisconsin and Medical College of Wisconsin. Areas of focus are medical devices, therapeutics, digital health, and diagnostics.

“We are delighted to be selected to work with the Wisconsin Investment Fund on this public-private partnership” said David Arnstein, Venture Investors managing director. “Our goal is to invest in the most promising healthcare investment opportunities in Wisconsin that will have a profound impact on human health.”

Serra Ventures | $7 million

Based in Champaign, Illinois, Serra Ventures focuses on investments in early-stage, emerging, and growth-stage technology companies in the Midwest. WEDC funds will only be used in Wisconsin.

Serra Ventures invests in early-stage technology companies throughout the U.S. Its current fund, the Serra-Grondex Ag & Food Tech Fund II, is an encore to the successful Serra Capital Ag Tech Fund, which launched in 2021. Serra provides venture funding to seasoned startup teams offering novel solutions for the world’s biggest problems in agriculture and food. The managing partners are former successful entrepreneurs who seek to serve their portfolio companies with real-world insight, hard work, and a valuable network. In addition to capital, Serra works alongside its entrepreneurs in all areas of growth, from strategic planning and partnerships to business development and capital formation.

“We are grateful to partner with the Wisconsin Economic Development Corporation to deploy capital to Wisconsin-based startups,” said Tim Hoerr, CEO and managing partner, Serra Ventures. “The state has a long and storied history in ag and food, so it is the perfect fit for Serra Ventures’ new fund. Our team at Serra looks forward to finding and funding the very best Wisconsin companies in the ag and food sector.”

NVNG Investment Advisors | $6 million

NVNG, based in Madison and Milwaukee, is dedicated to making Wisconsin’s startup ecosystem globally competitive.

NVNG is co-founded by Carrie Thome and Grady Buchanan, whose experience marries institutional investing and a passion for entrepreneurship. Their recently closed Fund I is a smart mix of a fund of funds and direct investments in Wisconsin startups, all designed to leverage the power of networks to drive positive returns and strategic and powerful connections.

“WEDC’s Wisconsin Investment Fund aligns very well with our vision of making Wisconsin’s entrepreneurial ecosystem globally competitive, and we’re looking forward to making meaningful investments in promising startups across the state,” said Carrie Thome, managing director and co-founder, NVNG.

Idea Fund of La Crosse | $5 million

The Idea Fund of La Crosse is a venture capital firm based in La Crosse dedicated to investing in pre-revenue and early-stage technology companies in Wisconsin, Minnesota, and Iowa. The firm focuses on software startups serving diverse markets, reflecting the region’s employment base. The Idea Fund has invested in 15 portfolio companies and currently manages $45 million on behalf of its limited partners.

“Founders in our region have shown that with the right resources and opportunities, they can succeed at the highest levels,” said Jonathon Horne, managing director, Idea Fund of La Crosse. “This investment will help us drive more startup growth and success right here in Wisconsin.”

WEDC is negotiating with a sixth fund manager for the Wisconsin Investment Fund’s remaining $5 million allocation.

An online version of this release is available here.