Communities of all sizes have established a Business Improvement District to help fund the mix of programming, public space investment, and property owner support necessary to support a vibrant downtown.

January 2025

Errin Welty, Wisconsin Main Street

One of the top challenges for downtown advocates is finding sustainable funding for the breadth of projects and programs needed to support a thriving downtown. Many traditional funding sources are limited in what they can fund or are inherently unreliable for capital planning. For example, grants often fund programs but not administrative overhead, while events, often used for fundraising, rely on good weather to draw attendees. Another funding source available in Wisconsin is the Business Improvement District (BID), a formal tax entity created within the municipal government structure by vote of property owners. Nearly 90 such districts have been established statewide to support revitalization initiatives. Districts exist in communities as small as 1,600 people, while others cover as many as 1,200 acres. Regardless of their size, BIDs provide funding support to further district goals, most commonly supporting dedicated staff to carry out events and outreach; investing in capital improvements such as parks, infrastructure, or streetscape amenities to further district investment; or coordinating marketing or other activities where collective action creates economies of scale and increases effectiveness, benefitting district property owners and businesses. Information on how to establish and engage a BID effectively to support revitalization work, along with updated information on Wisconsin assessment trends, activities, and staffing, is provided in this article.

Creating a BID

Wisconsin Act 184, signed into law in 1984, gives Wisconsin municipalities the power to establish one or more BIDs within their community, established by a vote of properties within the district(s). To pass, property owners representing at least two-thirds of the assessed value within the proposed district boundaries must be in favor of its creation. Once established, an additional dedicated tax assessment is set by a district board of directors composed largely of property owners from within the district. District funds are dedicated to support supplemental projects and programs related to the promotion, management, maintenance, and development of the district. The operating plan and rate structure are also formally approved by the municipal governing body during the annual budgeting process. Assessments are restricted to commercial and industrial properties within a municipality that are subject to real estate tax.

Structuring BID activities

Landscaping, planters, and hanging baskets are a large budget items for many BID districts.

Depending on the location and role of other local partners, BIDs play many roles within their district. Some typical arrangements include:

- Staffed District. Under this organizational structure, staff is hired by the BID board directly, either as a municipal employee or as an independent contractor. This staff is tasked with carrying out the district’s operating plan and investing BID dollars in activities approved by the board. In this model, the BID board is active in managing the day-to-day operations of the district.

- Contract for Service. Other BID boards may elect to contract with one or more outside organizations to carry out the operating plan. Contracts might include direct services, such as landscaping installations and maintenance, or service contracts to provide staffing and manpower to perform activities. Often, these service contracts are with dedicated downtown management organizations, but contracts may also exist with local tourism entities, marketing firms, or chambers of commerce. In this model, the BID board meets infrequently and its primary purpose is to establish a vision and goals, monitor progress, and approve any necessary adjustments to the operating plan.

- Hybrid Model. In this arrangement, the BID board may choose to oversee some activities directly and contract with one or more organizations for others. The most common tasks retained by the BID board are related to security and cleanliness of the district. In larger communities, BIDs may engage dedicated contract staff or a district management firm to provide ambassadors, security, trash, and cleaning services in the district.

In many mature districts, BIDs work alongside other partner organizations to benefit the downtown. Each of these partners has a unique legal structure, maximizing potential revenue streams for the district. Common BID partners include charitable non-profit organizations, membership-based merchant associations, limited liability real estate entities, and foundations. While each organization may have projects or programs that benefit the same district, each entity has a slightly different mission and a dedicated board of directors. These partnerships expand the number of individuals engaged in supporting the district, and the various entities often contract or sign memorandums of understanding with one another to coordinate services and share physical or staffing resources.

Wisconsin BID trends

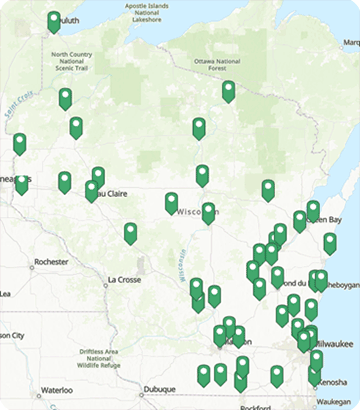

2024 Wisconsin Business Improvement District Locations

The most recent BID report is an update to a 2017 report produced by UW Extension summarizing the location, assessment rate, and methodology of all BIDs in the state. In 2024, there are 88 total active BIDs in the state, a net gain of one district since 2017. In this time, four BIDs have been created and three were terminated.

These districts are located in communities of all sizes and geographies, as shown on the map above. Milwaukee is home to 32 separate districts. In the rest of the state, nearly half of districts are in communities of fewer than 20,000 residents, 22% are in communities of 20,000-50,000, and 31% in large communities outside of Milwaukee. Most districts are established to incorporate properties within the same geographic and economic market, since these property owners are more likely to have common economic interests. Districts often coincide with other existing districts, such as historic districts, tax increment finance districts, or commercial zoning maps. As a result, districts range in size from a handful of blocks or parcels (for example, Tomahawk and West Allis encompass a portion of 10-12 blocks, and Reed Street Yards includes 10 parcels) to extended corridors or large acreages (Historic King Drive extends over 4 miles, and the Menomonee River Valley encompasses 1,200 acres). On average, districts include roughly 150 parcels.

Each commercial taxable property in the BID is assessed based on a formula determined by the Board of Directors. Most BIDs assess a simple mill rate added to the tax bill received by eligible property owners in the district. In most cases, property assessment / 1,000 * mill rate = BID contribution. While this is the most common assessment method, some districts utilize alternate assessment methods. Cesar E. Chavez Drive in Milwaukee, for example, has an assessment of $500 per property regardless of property value. The Kinnikinnic River BID, also in Milwaukee, uses an assessment of $1.70 per linear foot of river frontage on the property. To avoid real and perceived conflicts among large and small owners in the district, BIDs also typically employ minimum and maximum assessments for individual parcels. This also helps ensure that property owners contribute an amount that reflects the value of services received. The typical minimum assessment ranges from $100-$500, with the typical maximum assessment of $3,500-$5,000, although actual rates depend on the average assessed value of properties within the district.

Between 2017 and 2024, BID mill rates in the state increased by $0.07 to an average rate of $2.51 per $1,000 in assessed value, an increase of 2.9%. Average BID assessment rates increased for all community sizes, with 34% of districts increasing assessment rates compared to only 10 districts in small and mid-sized communities that assessed a lower value per property in 2024 than in 2017. Note that each of these districts with a net decrease in assessments operates on a budgetary assessment basis and did not actively vote to reduce the rate, but rather set an annual operating budget that grew slower than property valuation, resulting in a net relative tax levy. Average current BID assessment rates (per $1,000 in assessed valuation) by district size are listed below. Within each category, district assessments vary by several dollars, with numerous districts of each size assessing rates of under $1.00 per $1,000 in value and others collecting more than $3.50 (and as much as $6.50) per $1,000.

- Small community districts (Under 20,000 in population): $2.09

- Medium districts (20,000-50,000 in population): $2.17

- Large districts (over 50,000 in population): $2.85

Overall, number and mill rates of BIDs stayed relatively consistent within the last decade, with districts in communities of all sizes providing a stable and locally-driven source of funding for downtown revitalization initiatives.