In March 2024, we highlighted numerous small historic properties that have taken advantage of federal and state historic preservation tax credits to fund the renovation of beloved properties throughout the state, creating opportunities for new businesses, lofts, and gathering spaces. And in May 2024, we provided a webinar illustrating the in-depth tax credit application process. In this edition, we’ll discuss transferring these credits to other entities. But first, a recap:

Owners of income-producing buildings that (1) are individually listed on the National Register of Historic Places, (2) are deemed eligible for listing, or (3) are contributing buildings within a National Register Historic District can apply for tax credits for the rehabilitation of their properties. If they apply and their renovation plans are approved, they can claim a credit for 20% of qualified rehabilitation costs on their federal income taxes—and, here in Wisconsin, another 20% on their state income taxes.

The federal credits can then be carried forward up to 20 years and carried back 1 year, and the state credits can be carried forward up to 15 years. Successfully accessing these credits often requires the services of experienced design, tax, and legal professionals, but the earned credits can often make the difference between a viable project and a pipe dream.

In some cases, the property owner or developer does not have enough tax liability in the time period covered to utilize all of their credits—or they might decide that having money up front to pay for the renovation costs is more advantageous to them than claiming the credits afterward. In these cases, they have the option, both with the federal and state credits, to transfer (sell) them to other entities, often for a percentage of the face value.

Transferring federal credits requires the buyer to become a limited partner in the project from the beginning, but state credits in Wisconsin can be transferred without forming a partnership. Transferring credits allows the owner to obtain equity for the project and/or to provide the capital needed to undertake the improvements. It also allows nonprofit, tax-exempt entities to take advantage of these credits to maintain or renovate their properties.

In this piece, we highlight three property owners who have leveraged those tax credits by transferring (selling) them to other entities and one where the owners weighed the options of transferring them but decided not to.

While most renovations using historic tax credits are larger projects with corporate ownership groups, these case studies highlight smaller-scale projects of the magnitude that’s most common in Wisconsin downtowns: projects that utilized less than $500,000 in claimed state tax credits, with a total project cost less than $2.5 million in eligible renovation expenses.

The experiences of these property owners in selling their credits can be informative for other owners looking to take advantage of this program. For instance:

- The amount of state historic tax credits sold varied greatly (from $21,000 to $300,000), with some owners selling only the portion of the credits they were unable to use and others selling all of the state credits in exchange for up-front equity to reduce interest rates on their loans.

- State Historic Preservation Tax Credits were purchased for between $0.80 and $0.86 per dollar of credits, depending on the size of the project and the amount of credits available.

- Using an accounting firm with tax credit experience (or one willing to learn) can make a big difference in the owner’s overall experience. In addition to CPA expenses, in some cases, the buyer may request a fee for administering the paperwork and annual disbursements.

- Owners will need to maintain excellent records, since expense accounting needs to be accurate and detailed. Itemizing expenses is necessary to clearly show which expenses are eligible for credits and which are not—both sets of figures that are important to the project.

- Working with architects and contractors throughout to understand the impact of design decisions on eligible and ineligible expenses can dramatically impact tax credit eligibility and therefore project income. Engaging these professionals early and often can reduce the number and size of amendments, which add time and cost to the project.

- The money earned from the sale of tax credits may be considered taxable capital gains. Consult the Wisconsin Department of Revenue’s FAQ page for more information related to Wisconsin taxes.

Leithold Music (La Crosse)

The renovation of this impressive 1889 building in downtown La Crosse took place in 2021-22. Working with a local preservation architect, the property owners developed a renovation plan that maximized tax credit opportunities as well as façade and architectural/engineering grants from the city. The owners kept some tax credits to offset future tax liabilities and sold $21,000 of their state credits (at $0.86 on the dollar) to a California firm. The sale of the credits helped to expedite loan repayment for the project and improve their operating cash flow. They were not able to find a buyer for their federal credits since it was too small of an amount to be marketable. Working closely with an outside CPA and the Department of Revenue ensured that the transfer went smoothly, and future obligations for the owner were limited to annual reporting in each of the first five years.

Peachtree Commons (Janesville)

This impressive renovation in downtown Janesville relied on the use of federal and state tax credits as part of the capital stack. The complete renovation of this three-story building ultimately cost 61% more than originally estimated, so the credits were an important source of project funds. However, finding a buyer for the state credits was challenging and time-consuming. While members of the ownership group were allowed to purchase the federal credits themselves, they could not do the same for the state credits. After reaching out to dozens of potential buyers, the best offer they received was from a Missouri bank offering to buy $350,000 of the state credits at $0.83 on the dollar. This resulted in a $60,000 financial gap that was hard to overcome, but selling the credits was still necessary to fund the project from the start.

This impressive renovation in downtown Janesville relied on the use of federal and state tax credits as part of the capital stack. The complete renovation of this three-story building ultimately cost 61% more than originally estimated, so the credits were an important source of project funds. However, finding a buyer for the state credits was challenging and time-consuming. While members of the ownership group were allowed to purchase the federal credits themselves, they could not do the same for the state credits. After reaching out to dozens of potential buyers, the best offer they received was from a Missouri bank offering to buy $350,000 of the state credits at $0.83 on the dollar. This resulted in a $60,000 financial gap that was hard to overcome, but selling the credits was still necessary to fund the project from the start.

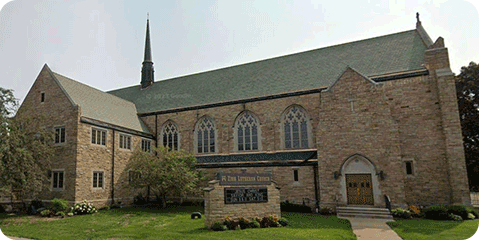

Zion Lutheran Church (Wausau)

Zion Lutheran Church is a stunning landmark in downtown Wausau, but its 75-year-old terra-cotta roof needed repair, with a price tag exceeding $500,000. Before they began, they decided to have the building listed on the National Register of Historic Places, so that it would be eligible for $104,000 in state Historic Preservation Tax Credits. As a nonprofit, the church couldn’t utilize the credits themselves, so they knew from the start that they had to find a buyer. They initially reached out to a bank headquartered in Wisconsin, but the bank didn’t have enough experience purchasing this type of tax credits and eventually declined. They found another bank that, after some delays, agreed to purchase the credits for $0.82 on the dollar. Despite losing out on 18% of the total tax credit amount, this allowed them to fund the roof replacement and plan for future exterior repairs to the building.

Zion Lutheran Church is a stunning landmark in downtown Wausau, but its 75-year-old terra-cotta roof needed repair, with a price tag exceeding $500,000. Before they began, they decided to have the building listed on the National Register of Historic Places, so that it would be eligible for $104,000 in state Historic Preservation Tax Credits. As a nonprofit, the church couldn’t utilize the credits themselves, so they knew from the start that they had to find a buyer. They initially reached out to a bank headquartered in Wisconsin, but the bank didn’t have enough experience purchasing this type of tax credits and eventually declined. They found another bank that, after some delays, agreed to purchase the credits for $0.82 on the dollar. Despite losing out on 18% of the total tax credit amount, this allowed them to fund the roof replacement and plan for future exterior repairs to the building.

Old Fire Station #5 (La Crosse)

The Old Fire Station #5 in La Crosse was an impressive renovation and reuse undertaken by a local preservation architect and his partners. During the rehabilitation, they had a broker willing to buy the state, but not the federal, credits. The offer was only $0.80 on the dollar; plus, the partners were unsure if monetizing the credits would create additional tax liability for them. Between the low offer and the tax uncertainty, they decided to keep the credits and use them the traditional way.

The Old Fire Station #5 in La Crosse was an impressive renovation and reuse undertaken by a local preservation architect and his partners. During the rehabilitation, they had a broker willing to buy the state, but not the federal, credits. The offer was only $0.80 on the dollar; plus, the partners were unsure if monetizing the credits would create additional tax liability for them. Between the low offer and the tax uncertainty, they decided to keep the credits and use them the traditional way.

We are grateful that these property owners agreed to have their projects featured here so we could all learn from their insightful responses. These stories demonstrate the challenges that can arise in the process of claiming and using these credits, how these project teams overcame those challenges, and the credits’ overall value in making historic rehabilitation projects feasible.